The Plot Twist: E-Book Sales Slip, and Print Is Far From Dead

by Alexandra Alter

The New York Times, Sept. 22, 2015

Five years ago, the book world was seized by collective panic over the uncertain future of print. As readers migrated to new digital devices, e-book sales soared, up 1,260 percent between 2008 and 2010, alarming booksellers that watched consumers use their stores to find titles they would later buy online. Print sales dwindled, bookstores struggled to stay open, and publishers and authors feared that cheaper e-books would cannibalize their business. Then in 2011, the industry’s fears were realized when Borders declared bankruptcy.

“E-books were this rocket ship going straight up,” said Len Vlahos, a former executive director of the Book Industry Study Group, a nonprofit research group that tracks the publishing industry. “Just about everybody you talked to thought we were going the way of digital music.”

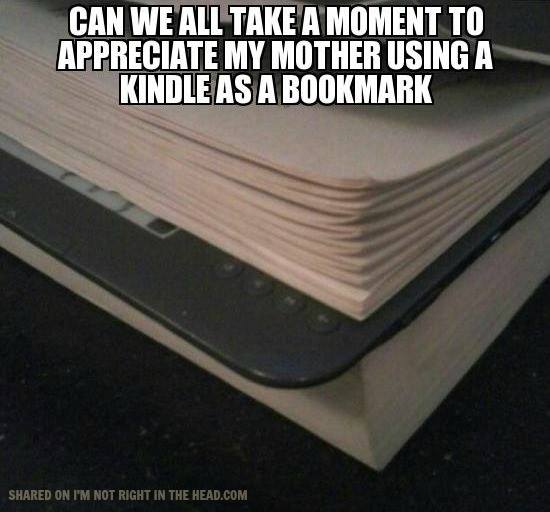

But the digital apocalypse never arrived, or at least not on schedule. While analysts once predicted that e-books would overtake print by 2015, digital sales have instead slowed sharply.

Now, there are signs that some e-book adopters are returning to print, or becoming hybrid readers, who juggle devices and paper. E-book sales fell by 10 percent in the first five months of this year, according to the Association of American Publishers, which collects data from nearly 1,200 publishers. Digital books accounted last year for around 20 percent of the market, roughly the same as they did a few years ago.

E-books’ declining popularity may signal that publishing, while not immune to technological upheaval, will weather the tidal wave of digital technology better than other forms of media, like music and television. E-book subscription services, modeled on companies like Netflix and Pandora, have struggled to convert book lovers into digital binge readers, and some have shut down. Sales of dedicated e-reading devices have plunged as consumers migrated to tablets and smartphones. And according to some surveys, young readers who are digital natives still prefer reading on paper.

The surprising resilience of print has provided a lift to many booksellers. Independent bookstores, which were battered by the recession and competition from Amazon, are showing strong signs of resurgence. The American Booksellers Association counted 1,712 member stores in 2,227 locations in 2015, up from 1,410 in 1,660 locations five years ago.

“The fact that the digital side of the business has leveled off has worked to our advantage,” said Oren Teicher, chief executive of the American Booksellers Association. “It’s resulted in a far healthier independent bookstore market today than we have had in a long time.” Publishers, seeking to capitalize on the shift, are pouring money into their print infrastructures and distribution. Hachette added 218,000 square feet to its Indiana warehouse late last year, and Simon & Schuster is expanding its New Jersey distribution facility by 200,000 square feet. Penguin Random House has invested nearly $100 million in expanding and updating its warehouses and speeding up distribution of its books. It added 365,000 square feet last year to its warehouse in Crawfordsville, Ind., more than doubling the size of the warehouse.

“People talked about the demise of physical books as if it was only a matter of time, but even 50 to 100 years from now, print will be a big chunk of our business,” said Markus Dohle, the chief executive of Penguin Random House, which has nearly 250 imprints globally. Print books account for more than 70 percent of the company’s sales in the United States.

.................

Some publishing executives say the world is changing too quickly to declare that the digital tide is waning.

“Maybe it’s just a pause here,” said Carolyn Reidy, the president and chief executive of Simon & Schuster. “Will the next generation want to read books on their smartphones, and will we see another burst come?”

by Alexandra Alter

The New York Times, Sept. 22, 2015

Five years ago, the book world was seized by collective panic over the uncertain future of print. As readers migrated to new digital devices, e-book sales soared, up 1,260 percent between 2008 and 2010, alarming booksellers that watched consumers use their stores to find titles they would later buy online. Print sales dwindled, bookstores struggled to stay open, and publishers and authors feared that cheaper e-books would cannibalize their business. Then in 2011, the industry’s fears were realized when Borders declared bankruptcy.

“E-books were this rocket ship going straight up,” said Len Vlahos, a former executive director of the Book Industry Study Group, a nonprofit research group that tracks the publishing industry. “Just about everybody you talked to thought we were going the way of digital music.”

But the digital apocalypse never arrived, or at least not on schedule. While analysts once predicted that e-books would overtake print by 2015, digital sales have instead slowed sharply.

Now, there are signs that some e-book adopters are returning to print, or becoming hybrid readers, who juggle devices and paper. E-book sales fell by 10 percent in the first five months of this year, according to the Association of American Publishers, which collects data from nearly 1,200 publishers. Digital books accounted last year for around 20 percent of the market, roughly the same as they did a few years ago.

E-books’ declining popularity may signal that publishing, while not immune to technological upheaval, will weather the tidal wave of digital technology better than other forms of media, like music and television. E-book subscription services, modeled on companies like Netflix and Pandora, have struggled to convert book lovers into digital binge readers, and some have shut down. Sales of dedicated e-reading devices have plunged as consumers migrated to tablets and smartphones. And according to some surveys, young readers who are digital natives still prefer reading on paper.

The surprising resilience of print has provided a lift to many booksellers. Independent bookstores, which were battered by the recession and competition from Amazon, are showing strong signs of resurgence. The American Booksellers Association counted 1,712 member stores in 2,227 locations in 2015, up from 1,410 in 1,660 locations five years ago.

“The fact that the digital side of the business has leveled off has worked to our advantage,” said Oren Teicher, chief executive of the American Booksellers Association. “It’s resulted in a far healthier independent bookstore market today than we have had in a long time.” Publishers, seeking to capitalize on the shift, are pouring money into their print infrastructures and distribution. Hachette added 218,000 square feet to its Indiana warehouse late last year, and Simon & Schuster is expanding its New Jersey distribution facility by 200,000 square feet. Penguin Random House has invested nearly $100 million in expanding and updating its warehouses and speeding up distribution of its books. It added 365,000 square feet last year to its warehouse in Crawfordsville, Ind., more than doubling the size of the warehouse.

“People talked about the demise of physical books as if it was only a matter of time, but even 50 to 100 years from now, print will be a big chunk of our business,” said Markus Dohle, the chief executive of Penguin Random House, which has nearly 250 imprints globally. Print books account for more than 70 percent of the company’s sales in the United States.

.................

Some publishing executives say the world is changing too quickly to declare that the digital tide is waning.

“Maybe it’s just a pause here,” said Carolyn Reidy, the president and chief executive of Simon & Schuster. “Will the next generation want to read books on their smartphones, and will we see another burst come?”